2024 Shredder Market Analysis for Foreign Trade Sourcing

The global shredder market continues to expand in 2024, driven by the rising focus on waste recycling and circular economy policies across regions. For foreign trade enterprises sourcing shredders, aligning with market trends is key to boosting export performance.

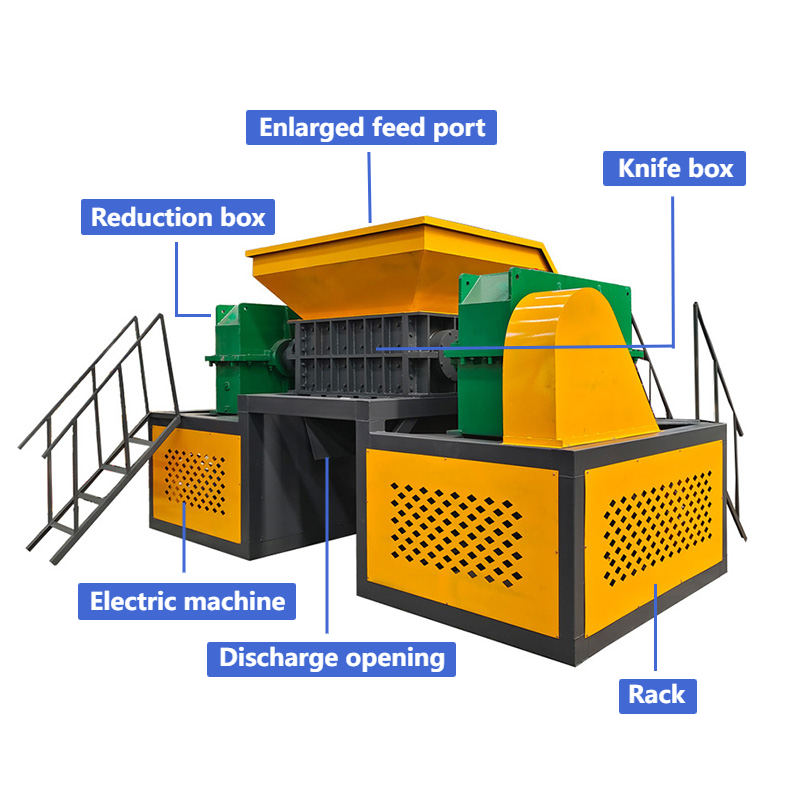

Demand for specialized shredders is on the rise. Dual-shaft shredders remain top-selling due to their versatility in handling diverse materials—from metal scraps to plastic waste and now, automotive components like scrap car seats. Small to medium-sized shredders (with hourly capacity 5-15 tons) are particularly popular, as they fit the needs of small and medium enterprises (SMEs) in emerging markets, which account for 45% of global shredder purchases.

Significant differences in regional preferences.In the European Union, shredders with CE certification and low energy consumption are mandatory, with buyers prioritizing noise reduction (below 75 decibels) for urban operations. In Southeast Asia, cost-effectiveness and easy maintenance are core demands—suppliers offering on-site repair training see 30% higher sales. North American markets favor smart shredders with remote monitoring functions, as waste management companies seek to cut labor costs.

Foreign trade sourcing tips: First, prioritize certifications matching target markets (CE for Europe, UL for North America). Second, bundle spare parts (like wear-resistant blades) with machines to enhance customer loyalty. Third, provide multilingual operation manuals—English and Spanish versions are essential for Latin American markets.

With the right product positioning, shredder exporters can tap into the $8.2 billion global market, as the demand for efficient waste processing shows no sign of slowing down.